Marks and Spencer (LSE:MKS) stock has seen a recovery of 30% over the past month. Its latest results indicate a tough road ahead, but its shares may be good value with a price-to-earnings (P/E) ratio of 8. So are Marks and Spencer shares a good buy for my portfolio?

Marked up costs

For its first half, M&S didn’t do as badly as anticipated. Revenue and overall sales volumes saw healthy increases. And while its bottom line dropped rather substantially, this can be attributed to a number of factors.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Statutory revenue | £5.56bn | £5.11bn | 9% |

| Profit before tax | £209m | £187m | 11% |

| Adjusted basic earnings per share (EPS) | 7.8p | 12.1p | -34% |

The company didn’t get similar tax relief to last year as a result of the pandemic winding down. And higher energy and labour costs ate into its margins. Additionally, M&S acquired its logistics provider, Gist, and capital expenditure rose 46%.

Should you invest £1,000 in Ashtead Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ashtead Group Plc made the list?

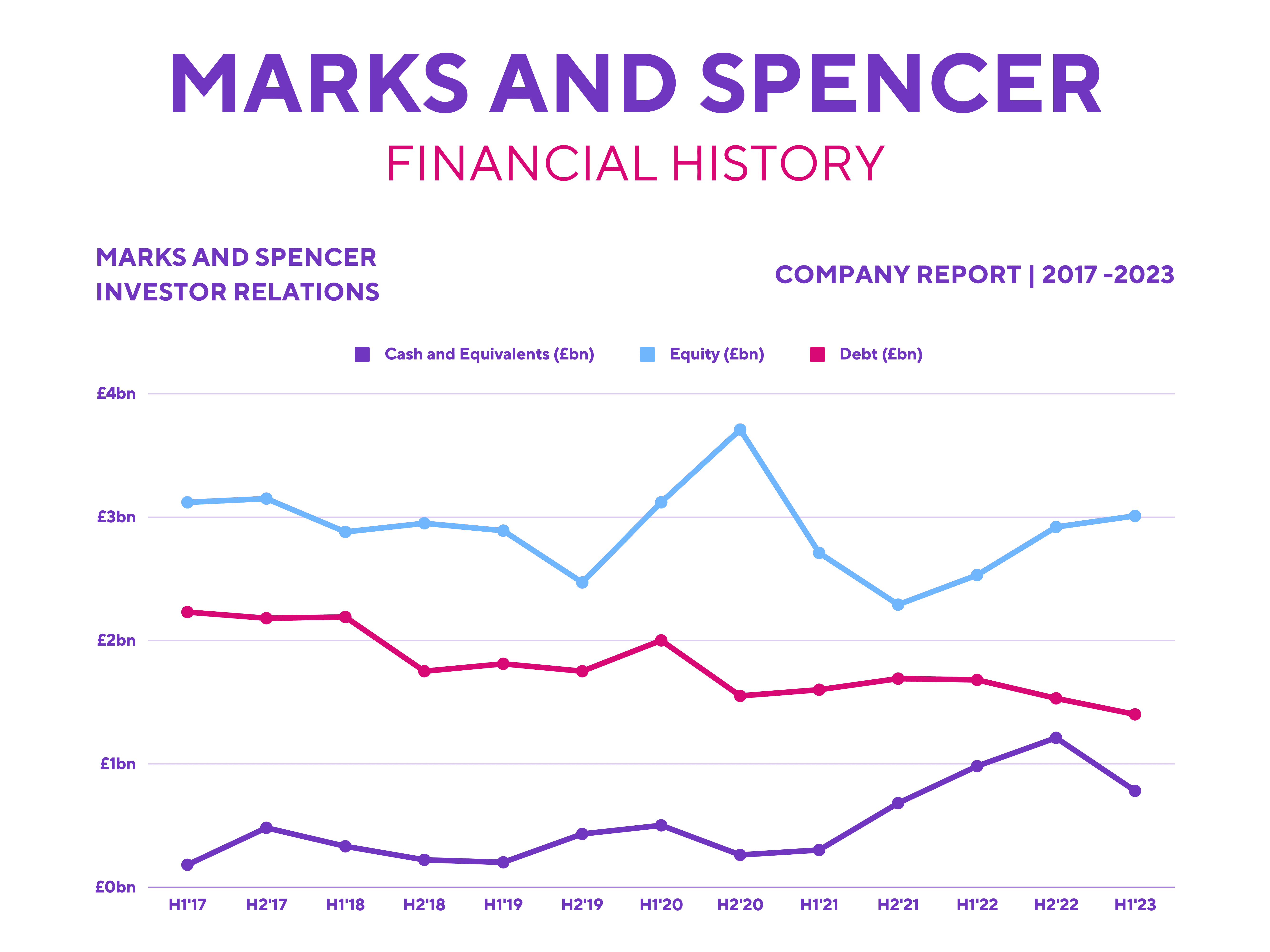

Its balance sheet continues to improve despite the tumultuous macroeconomic environment. While debt levels remain high at £1.4bn, it’s worth noting that the company has £1.63bn worth of liquidity, consisting of £783m in cash and equivalents, and an £850m revolving credit facility.

Making a mark

M&S is renowned for its slightly more expensive food offerings. As such, analysts and investors alike were expecting sales to plummet during the current cost-of-living crisis. However, the retailer bucked the trend and surprised them. This could be attributed to the combination of a belief in M&S’s strong value credentials, despite its prices, and the Veblen effect. That’s essentially abnormal consumer behaviour caused by the belief that higher prices mean higher quality or value.

For that reason, I was delighted to see the numbers Marks and Spencer shared. Both Food and Clothing & Home (C&H) sales volumes saw increases. And growth in like-for-like (LFL) sales outperformed the overall industry and many of its supermarket peers over the last six months.

| Metrics | LFL food sales growth |

|---|---|

| Marks and Spencer | 6.8% |

| Tesco | 3.2% |

| Sainsbury’s | -0.8% |

Aside from that, the firm also saw footfall to its stores rising along with transaction frequencies. As a result, the FTSE 250 firm’s C&H segment gained 50bps of market share on the back of strong volume growth. And with a number of exciting new clothing lines, valuable food items, and more affordable gifts launching, the jump in the share price is understandable.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| UK footfall per week | 14.6m | 13.2m | 11% |

| UK transactions per week | 10.5m | 9m | 17% |

Sparkly Christmas

Many retailers have been warning of a slow Christmas this year, but M&S reported the opposite. In fact, co-CEO Katie Bickerstaffe cited its customers spending more this year due to their more affluent backgrounds.

Management still warned investors of a stormy FY24, as high inflation is expected to continue biting into the firm’s bottom line and to impact consumer spending. Yet I believe inflation may have peaked, based on energy prices levelling off and commodity prices tumbling. Therefore, I think M&S’s bottom line could get a boost in FY24 instead, which should be further helped by the Gist acquisition and the £150m in cost savings the board has planned.

Are Marks and Spencer shares a buy for me then? Well, Barclays recently reiterated its ‘overweight’ rating for the stock with an average price target of £1.55, a 24% upside from current levels. So, despite having bought a substantial number of shares at £1, and already being up 20%, I’m still planning to buy more shares and definitely not selling. This is due to M&S’s robust performance and what I see as a bright long-term future.